Although our firm, OCG, enjoys the professional challenge, we can’t pretend it’s simple to set the compensation levels in an emergent technology company. We frequently suggest the addition of a performance unit plan to the comp mix in this environment.

Of course, setting the compensation in a tech startup is easy if the investors impose their preferences. In the absence of investor constraints, high tech executive comp can require a balance among salary, bonus, and long-term compensation which may as likely find a firm bidding with itself to attract talent as it may involve a traditional market pay analysis.

Regardless of the methodology, founders generally receive less cash (in terms of salary and bonus) and more equity (in long-term comp) than later hires, although such non-founders can reap more cash but realize less equity. In fact, some original research by Prof. Noam Wasserman of the Harvard Business School suggests the existence of a “founder’s discount” in the compensation of tech company founders. This may be due to a fixation of early personnel upon mission rather than reward, a byproduct of early company cash starvation, and/or a design by the firm’s board of directors to limit rewards with the calculation that founders have little impetus to shop their talents elsewhere.

In any event, early stage tech compensation may see a combination of salary, bonus, options, and founder’s stock. There is, however, an alternative which, if added to the mix, requires no outlay by the executive (as with founders’ stock) and which promises to direct the person’s attention from stock value (as with options) toward company performance objectives – a performance unit plan.

A performance unit plan (PUP) can be illustrated as follows. An executive is awarded 5,000 performance units, with the value of each set at $7.50. The applicable measure is, say, growth in EBITDA to a figure of $1.00 during a term of 3 years. If this target is met within this period, the executive receives $37,500 in cash, above and beyond any other rewards. If EBITDA reaches only $0.98 over 3 years, there is no award/reward.

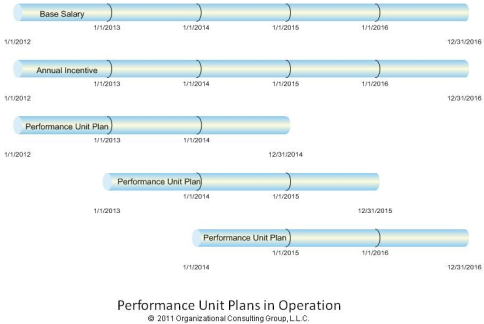

A performance unit plan can be rolling, if desired, beginning, for example, each year for a 3-year term. Ignoring, for the sake of limiting visual clutter, devices such as options and founders’ stock, a PUP can be visualized within a compensation plan in this fashion:

It should be apparent, then, that a performance unit plan can nestle within and compliment a common compensation plan. In particular, a PUP has the virtues of:

- Requiring no investment by the executive,

- Imposing no tax liability at the time of grant,

- Aligning rewards directly to the performance desired and achieved,

- Producing no outstanding share dilution (because no shares are involved), and

- Diversifying the compensation provided to an individual or group of executives.

The down side is that the value of the performance units awarded is charged to earnings. As for tax consequences:

- At the time of payment, the payout is taxed to the executive at ordinary income rates,

- With payment, the company receives a tax deduction for compensation expenses.

We’ve confined this discussion to the utility of performance units within an early stage high technology company. It doesn’t require much imagination, however, to conclude that a PUP also has value in a mature tech company, a biotech firm, or pretty much any type of enterprise requiring a stock option alternative with the flexibility of being tailored to any number of financial or performance metrics.